Smartphone vendors just experienced two back-to-back quarters without significant market growth, reveals International Data Corporation’s (IDC) latest Worldwide Quarterly Mobile Phone Tracker report.

In total, they shipped 343.3 million smartphones during the second quarter (Q2) of 2016, a negligible 0.3 percent year-over-year gain. On the bright side, shipments rose 3.1 percent compared to the previous quarter (333.1 million units).

Ryan Reith, program vice president at IDC Worldwide Quarterly Mobile Device Trackers, noted that are adjusting their product plans and business strategies to cope with a market that is no longer experiencing runaway growth.

“Mature markets continue the transition away from pure subsidy and over to EIP [equipment installment plan] programs and Apple is beginning to put more emphasis on ‘Device as a Service’ to try to prevent lengthening replacement cycles,” said Reith in a statement. “This is a growing theme we have heard more about from PCs to smartphones.”

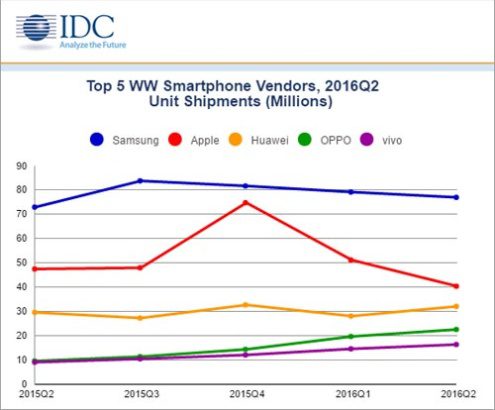

Samsung, buoyed by demand for its Galaxy S7 and S7 Edge flagship phones, maintained its perch at the top of the market in Q2 with shipments of 77 million smartphones and a 22.4-percent share of the market, a 5.5 percent year-over-year increase. “The new models proved to be the right mix of style and features and helped Samsung grow profits in the quarter. The inclusion of removable storage, waterproofing, and faster processor proved to be the winning combination for Samsung as consumers flocked to the new model,” stated IDC.

Second-place Apple slipped 15 percent, shipping 40.4 million iPhones compared to 47.5 million last year. While it raised some eyebrows when it was announced back in March, releasing the iPhone SE — essentially an iPhone 5/5S with the guts of an iPhone 6S — turned out to be a smart move by the Cupertino, Calif.-based device maker.

The handset was a hit in both emerging and mature markets, said IDC. First-time buyers and users switching from Android flocked to the relatively affordable hardware. On the downside, the iPhone SE drove down the iPhone’s average selling price to $595 in Q2 from $662 a year ago.

Rounding out the top five are Huawei, OPPO and vivo. OPPO saw its shipments surge 136.6 percent to 22.6 million units, on the strength of its flagship R9 handset, an increase in its marketing efforts and inroads made in emerging markets including India and Indonesia.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.