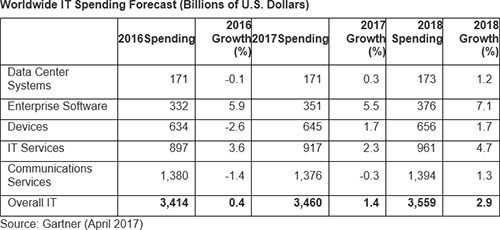

Gartner has revised its Worldwide IT Spending Forecast downward to reflect the status of the American dollar and significant shifts in the market’s dynamics.

IT spending is anticipated to reach $3.46 trillion in 2017, a 1.4 percent increase. Previously, the research firm predicted that spending would rise 2.7 percent. Part of the reason Gartner amended its forecast involves the strength of the U.S. dollar.

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

“The strong U.S. dollar has cut $67 billion out of our 2017 IT spending forecast,” said John-David Lovelock, research vice president at Gartner, in a statement. And as it turns out, many technology giants call the U.S. their home.

“We expect these currency headwinds to be a drag on earnings of U.S.-based multinational IT vendors through 2017,” Lovelock continued.

Data center IT equipment vendors will experience a slight rebound in 2017 (0.3 percent) after negative growth last year. Challenges remain for server makers as businesses increasingly look to the cloud for compute resources, however.

“We are seeing a shift in who is buying servers and who they are buying them from. Enterprises are moving away from buying servers from the traditional vendors and instead renting server power in the cloud from companies such as Amazon, Google and Microsoft,” stated Lovelock. “This has created a reduction in spending on servers which is impacting the overall data center system segment.”

All told, the data center systems segment will attract $171 billion in revenue, predicted Gartner.

The biggest winners this year will be the enterprise software and IT services segments, with gains of 5.5 percent and 2.3 percent, respectively. Enterprise software revenue is poised to reach $351 billion while IT services providers will generate $917 billion in sales.

The devices segment, buoyed by strong mobile phone sales and modest gains for PC, tablets and printer makers, will hit $645 billion in revenue this year, a 1.7-percent gain. Gartner recently forecast that the mobile phone market will approach the $400 billion mark as buyers flock to Samsung’s new premium phone, the Galaxy S8, and Apple’s 10th anniversary iPhone later this year. In emerging markets, buyers are leaving their basic phones behind, opting for higher-quality devices from vendors like Huawei and Oppo.

Finally, the communications services segment is expected to shed 0.3 percentage points in 2017, reaching $1.376 billion.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.