The results are in. According to analysis of the cloud computing market from Synergy Research, revenues are close to hitting the $150 billion milestone.

Across the board, cloud consumption was up last year. In total, cloud vendors generated $148 billion in sales during the four quarters ending Sept. 30, 2016, a 25 percent increase on a yearly basis. The market also reached a crucial tipping point in 2016, observed, Synergy Research chief analyst and research director John Dinsdale.

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

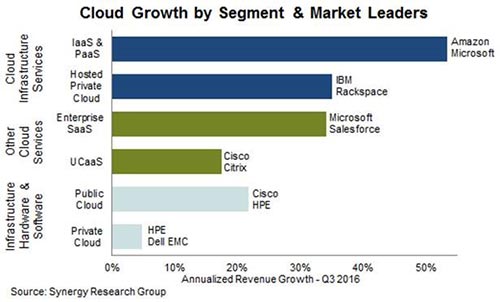

“Among the segments, IaaS/PaaS [Infrastructure as a Service/Platform as a Service] saw the highest growth rates and for the first time cloud services in aggregate generated more revenue than hardware and software used to build cloud infrastructure,” Dinsdale said. In the period spanning the fourth quarter of 2015 and the third quarter of 2016, cloud infrastructure spending hit $65 billion. Meanwhile, cloud vendors raked in an estimated $70 billion.

“Cloud usage had already entered the mainstream and now cloud is starting to dominate IT markets – and what’s more high growth rates will persist for many more years,” he continued.

Amazon and Microsoft are the IaaS and PaaS services leaders. Collectively, the segments are growing at a rate of 53 percent each year. IBM and Rackspace sit atop the hosted private cloud space, which is also expanding at brisk pace with a 35 percent increase.

Microsoft and Salesforce reign the enterprise SaaS (Software as a Service) segment, another high-growth category with a 34-percent annual growth rate. Cisco and Citrix dominate the Unified Communications as a Service (UCaaS) segment.

Cisco and Hewlett Packard Enterprise (HPE) are the top providers of hardware and software for public cloud operators. HPE and Dell EMC are the private cloud vendors of choice, observed the analysts at Synergy Research.

All told, the cloud is a big money maker for several IT industry heavyweights.

“We tagged 2015 as the year when cloud became mainstream and I’d say that 2016 is the year that cloud started to dominate many IT market segments,” said Jeremy Duke, founder of Synergy Research, in a statement. “Major barriers to cloud adoption are now almost a thing of the past, especially on the public cloud side. Cloud technologies are now generating massive revenues for technology vendors and cloud service providers and yet there are still many years of strong growth ahead.”

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.