The cloud computing market continues to climb higher.

Yesterday, Amazon reported that its cloud division had generated sales of $2.56 billion in the first quarter (Q1) of 2016, a 64 percent year-over-year increase. The ecommerce giant’s fast-growing Amazon Web Services (AWS) division helped it post a profit of over a half-billion dollars, or $1.07 per share, on revenues of $29.1 billion. Wall Street analysts had expected 58 cents a share.

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

With all the major cloud providers accounted for in Q1, Synergy Research crunched the numbers and found that in aggregate, the cloud infrastructure services market has surpassed the $7 billion per quarter milestone.

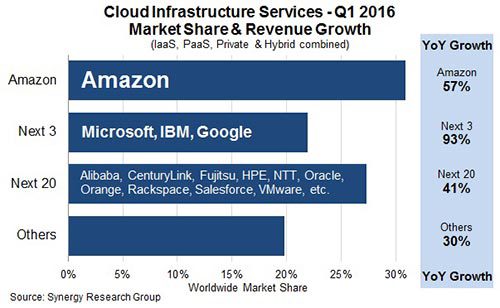

Among the top providers, AWS is comfortably in the lead, according to Synergy chief analyst and research director, John Dinsdale. “Amazon/AWS remains in a league of its own with a worldwide market share of 31 percent, but Microsoft and Google both have tremendous triple-digit growth rates and are at least narrowing the gap a little,” he remarked in a research note sent to Datamation.

By comparison, Microsoft, IBM and Google combined account for 22 percent of the market. Microsoft and Google are quickly gaining ground, with annual growth rates of over 100 percent each, according to Synergy’s data.

The next 20 cloud providers in the rankings — a group that includes Oracle, Rackspace, Salesforce and VMware — accounts for 27 percent of the cloud computing market and is growing at an average 41 percent a year. Considering that the market is expanding at a rate of over 50 percent per year, Synergy concludes that most of them are shedding market share.

Proving the truism that one must spend money to make money, the top four’s (Amazon, Microsoft, IBM and Google) out-sized cloud data center investments appear to be placing the smaller players at a disadvantage.

With its feature-packed, globe-spanning cloud, Amazon has been successful in attracting a big customer base, including several major enterprises. “AWS started with developers and startups, and now is used by more than a million customers from organizations of every size across nearly every industry – companies like Pinterest, Airbnb, GE, Enel, Capital One, Intuit, Johnson & Johnson, Philips, Hess, Adobe, McDonald’s, and Time Inc.,” wrote Jeff Bezos, founder and CEO of Amazon, in an April 5 letter to shareholders.

Competing against Amazon and its high-flying peers may seem like a daunting challenge for smaller cloud providers. For these hopefuls, Dinsdale suggests that the road the cloud success may be paved with specialized or region-specific offerings.

“One of the bigger questions is what does this mean for the rest of the cloud providers? Clearly most cannot effectively compete head-to-head with the hyperscale cloud leaders as they invest billions of dollars in their data center footprints, so the smaller players need to focus on something a little different,” said Dinsdale.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.