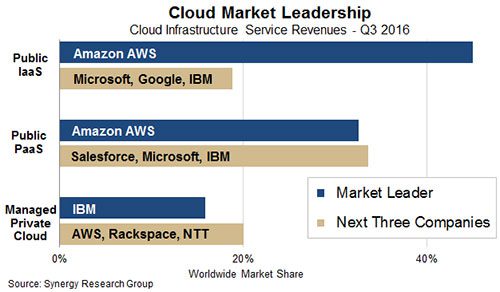

The third-quarter results are in and Amazon Web Services (AWS) has a commanding lead in the worldwide public infrastructure-as-a-service (IaaS) market.

“In many ways, public IaaS is the poster child of cloud computing and in that segment Amazon/AWS absolutely dominates the market, with a worldwide market share of 45 percent in Q3,” said John Dinsdale, chief analyst and research director at Synergy Research Group, in a research note sent to Datamation. It’s an impressive feat, given how quickly rival cloud platforms are growing.

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

“That market share has been achieved despite Microsoft and Google both continuing to grow their cloud service revenues at well over 100 percent per year,” continued Dinsdale. Nonetheless, Amazon is still more than twice as big as Salesforce, Microsoft and IBM combined.

AWS also leads the public platform-as-a-service market, although not by as wide a margin. “While Amazon is not quite so dominant in public PaaS it is still almost as big as its three nearest competitors combined,” Dinsdale noted.

Meanwhile, IBM is the private cloud company to beat. “Only in managed private cloud does Amazon have to take a back seat, with IBM being the undisputed leader in that segment,” added Dinsdale.

In total, Synergy Research estimates that cloud infrastructure service revenues were more than $8 billion last quarter and are growing at a rate of 50 percent per year. Public IaaS is the biggest money maker, but growing demand for cloud-based Internet of Things (IoT), analytics and database solutions – segments that are each growing at 100 percent or more per year – is adding momentum to the market for PaaS solutions.

Continued cloud demand is also affecting the IT infrastructure market.

IDC expects cloud IT infrastructure spending on servers, Ethernet switches and enterprise storage to climb 16.2 percent this year, reaching $37.4 billion. By 2020, the analyst firm said that figure will hit $60.8 billion.

“This demand for cloud services will continue to drive the underlying shift in IT infrastructure spending from on-premises to off-premises deployments,” commented IDC research director Natalya Yezhkova, in a statement. “As public cloud data centers represent the major segment of off-premises IT infrastructure deployments, overall spending done by this segment is closely tied to spending by public cloud service providers, in particular, hyperscale [service providers].”

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.