The sight of employees toiling away with augmented or virtual reality (AR/VR) gear strapped to their faces will become increasingly common over the next few years, according to a new forecast from IDC.

In 2021, the worldwide sales of AR and VR solutions will reach $215 billion predicts the technology research firm, a lofty amount compared to the estimated $11.4 billion the industry is poised to rake in this year. During the forecast period, which stretches from 2016 to 2021, the market will more than double each year, achieving a compound annual growth rate (CAGR) of over 113 percent.

For now, game- and entertainment-focused solutions for consumers rule the market. But over time, the industry is expected to start putting work before play, at least in the U.S.

This year, demand from the discrete manufacturing and process manufacturing segments will follow the consumer space. In Asia-Pacific (excluding Japan), retail and education will follow the consumer segment.

Looking ahead, process and discrete manufacturing, government, retail, construction, transportation and professional services will all pull ahead of consumer spending in the U.S. by 2021. Consumers are expected to continue to drive the market in Asia-Pacific (excluding Japan) and Western Europe throughout IDC’s forecast.

“Augmented and virtual reality are gaining traction in commercial settings and we expect this trend will continue to accelerate,” said Tom Mainelli, program vice president of Devices and AR/VR at IDC, in a statement. “As next-generation hardware begins to appear, industry verticals will be among the first to embrace it. They will be utilizing cutting-edge software and services to do everything from increase worker productivity and safety to entice customers with customized, jaw-dropping experiences.”

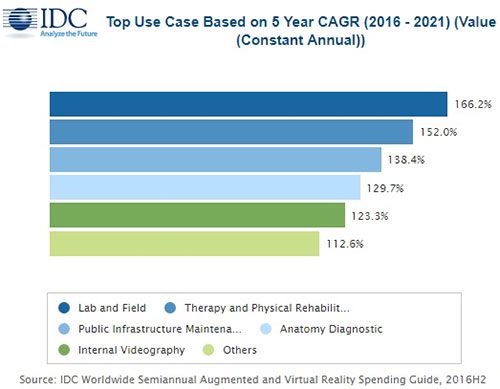

Lab and field implementations that allow users to conduct research and run experiments, will be the fastest growing use case for AR/VR with a CAGR of over 166 percent, said IDC. Therapy and physical rehabilitation (152 percent) and public infrastructure maintenance (138 percent).

The top money-making commercial use case in 2017 will be retail showcasing, generating $442 million in revenue for AR/VR vendors. On-site assembly and safety takes second place with $362 million, followed by training in manufacturing environments with $309 million.

Retail showcasing will fall to third place in 2021 ($3.2 billion), succumbing to increased demand for solutions that aid in industrial maintenance ($5.2 billion) and help communities keep up their public infrastructure ($3.6 billion).

These figures can’t hold a candle to the consumer space. Driven by AR and VR games, worldwide consumer spending will reach $9.5 billion in 2021, anticipates IDC.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.