Demand for basic wearables, defined as wearable devices that don’t run third-party apps by International Data Corporation (IDC), is slipping.

In the second quarter of 2017, vendors shipped 26.3 million wearables worldwide, a 10.3 percent year-over-year increase, said IDC. Shipments of basic wearables dropped slightly (0.9 percent decline), a first for the segment while the smartwatch category shot up.

Bolstered by improving Apple Watch and Android Wear sales, smartwatch shipments jumped 60.9 percent in Q2 on an annual basis, the research firm discovered.

“Smartwatches recorded double-digit year-over-year growth, with much of that increase attributable to a growing number of models aimed at specific market segments, like the fashion-conscious and outdoor enthusiasts in addition to the technophile crowd, lower price points, and a slowly-warming reception from consumers and enterprise users alike,” said IDC research manager Ramon Llamas, in a statement. “Factor in how smartwatches are taking steps to become standalone devices, and more applications are becoming available, and the smartwatch slowly becomes a more suitable mass market product.”

Once considered “gateway” wearables, fitness trackers are losing ground to smartwatches, IDC noted. Whereas GPS tracking and advanced health monitoring capabilities were once considered niche features, they are now becoming part of the stock smartwatch experience.

Other fast-growing segments include smart clothing and earwear, Llamas said. Both notched triple-digit growth in Q2, although it’s early days and these products typically cater to a specific clientele, like professional athletes in the case of smart clothing.

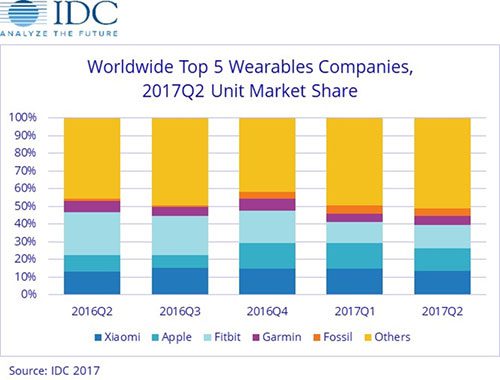

The wearables race is also a tight one, according to IDC’s wearables vendors rankings.

Xiaomi is the top wearable device company, having shipped 3.5 million devices and captured 13.4 percent of the market. Second-place Apple shipped 3.4 million Watches and claimed 13 percent market share. Wearables pioneer Fitbit took third place with shipments of 3.4 million units and a 12.9-percent share of the market.

This week, Fitbit signaled a shift from its basic fitness-tracking roots by unveiling Ionic ($299.95), a new smartwatch that supports third-party apps. Available in October, the Iconic’s App Gallery will feature apps from Pandora and Starbucks, among others.

But don’t expect Fitbit to soften its focus on fitness.

“With Ionic, we will deliver what consumers have not yet seen in a smartwatch – a health and fitness first platform that combines the power of personalization and deeper insights with our most advanced technology to date, unlocking opportunities for unprecedented health tracking capabilities in the future,” James Park, co-founder and CEO of Fitbit, said in an Aug. 28 announcement.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.