Vendors shipped 27.4 million wearable devices worldwide during the fourth quarter of 2015, a 126.9 percent year-over-year gain according to International Data Corporation’s (IDC) Worldwide Quarterly Wearable Device Tracker. For all of 2015, they shipped a total of 78.1 million units, a 171.1 percent increase over 2014’s figures.

In short, wearables are well on their way to going mainstream.

“Triple-digit growth highlights growing interest in the wearables market from both end-users and vendors. It shows that wearables are not just for the technophiles and early adopters; wearables can exist and are welcome in the mass market,” stated IDC research manager Ramon Llamas in a media advisory.

Though the market it on a tear, not everyone is having their vitals tracked or glancing at text messages on their wrists. For device makers, there are still opportunities to make a splash, suggested Llamas.

“And since wearables have yet to fully penetrate the mass market, there is still plenty of room for growth in multiple vectors: new vendors, form factors, applications, and use cases. This will help propel the market further,” he continued.

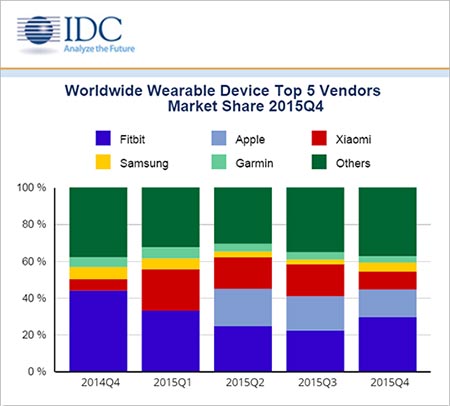

Fitbit won the fourth quarter, with shipments of 8.1 million units and a 29.5 percent share of the market. Apple claimed second place by shipping 4.1 million Watches and snagging 15 percent of the market. Xiaomi, Samsung and Garmin round out the top five.

For all of 2015, first-place Fitbit shipped 21 million units and walked away with nearly 27 percent of the market. China’s Xiaomi, a maker of low-cost fitness wearables, came in second with shipments of 12 million devices and 15.4 percent of the market. In terms of growth, Xiaomi was far and away the market leader in 2015 with a year-over-year growth spurt of 951.8 percent compared to Fitbit’s 93.2 percent bump.

“Xiaomi’s focus on inexpensive fitness trackers resonated within China, with prices far below the competition (as low as $11 USD), making the Mi Band an inexpensive purchase,” observed Gartner. “This allowed Xiaomi to have the largest year-over-year improvement of any vendor on our list.”

Apple, whose smartwatch shipped in late April, managed to take third place with shipments of 11.6 million units and a 14.9 percent share of the market. Garmin and Samsung came in third and fourth, respectively, each with roughly 3 million devices shipped last year.

For continued growth, vendors are better served by revving up their innovation engines rather than keeping up with the Fitbits, suggested Llamas.

“End-users expect improvement from what they have now, and new applications to spur replacement and increased adoption. Historical data, like steps taken and calories burned, has been a very good start,” he stated. “Prescriptive data, like what else a user can do to live a healthier life, coupled with popular applications like social media, news, and navigation, will push wearables further, and attract more users.”

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.