The bigger they are, the higher they float?

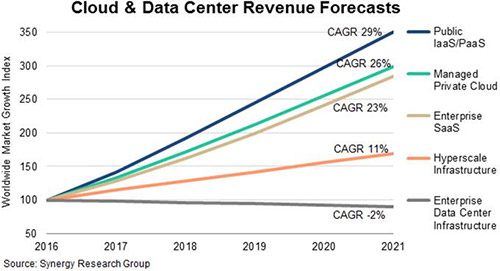

The world’s cloud services and software-as-a-service (SaaS) providers will generate more than $200 billion in revenue in 2020, predicts a new forecast from Synergy Research Group. On its way to this lofty milestone, the industry is expected to expand at a compound annual growth rate (CAGR) of 23 percent to 29 percent.

Cloud Storage and Backup Benefits

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

As the saying goes, a rising tide lifts all boats. But in this case, smaller providers may encounter rougher waters.

“Analysis of the main cloud providers over the last three years show that they are all maintaining or growing their share of the cloud market, so the forecast points to the possibility of them continuing to enjoy strong growth,” observed John Dinsdale, chief analyst and research director at Synergy Research Group, in email remarks sent to Datamation. “Expansion of cloud services will also help drive continued growth in the supply of data center infrastructure for the hyperscale cloud providers.”

In fact, growing demand for cloud services is raising sales of IT infrastructure to hyperscale cloud data center operators by 11 percent each year.

With an annual growth rate of 29 percent over the forecast period (2016 – 2021), the public infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) segment of the market is likely to snap up servers, storage and networking equipment at a brisk clip. Hosted and managed private cloud companies (26 percent CAGR) and enterprise SaaS providers (23 percent CAGR) and are also expected to score an increasing amount of sales over the next few years.

“The flipside of these opportunities is that non-hyperscale cloud providers and suppliers of infrastructure to traditional data centers will be under pressure and will have some interesting waters to navigate,” added Dinsdale.

Simply put, hyperscale cloud providers are dominating the market. According to his firm’s research, 24 hyperscale companies operate 360 cloud data centers across the globe. Each year, that tally grows by nearly 20 percent.

In a few short years, smaller providers may have precious little room in which to navigate. Synergy Research expects that hyperscale cloud companies will soon attract 80 percent of all SaaS and cloud services revenues while taking responsibility for approximately 40 percent of all spending on public and private data center equipment.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.